Alternatives to Ebanx when making Payments in Brazil

Check it out if you want to accept payments from Brazil.

Ebanx is going through a tough time now related to their customer satisfaction both on the client side and buyer side.

Today, we’re going to show you alternatives to Ebanx if you want to accept payments from Brazil and Latin America in general and why exactly would you prefer such options. Check it out!

Why would you not use Ebanx?

Now sure, you’re looking for alternatives for Ebanx already, but why would a company choose to not use one of the most successful payment gateways in Brazil?

First off, let’s talk about price. Ebanx is not very transparent about pricing. If you look on their website you’ll notice that there are no mentions of how they charge for their services.

If we check online, we’ll find that there is a 200 USD subscription fee per month plus fees. That’s mostly fine if you have a bigger business, but it is a reason to be concerned if you run a smaller operation.

A monthly fee can be a problem if you’re trying to validate a market. If you’re just starting out, or if you don’t have a continuous flux of cash coming from Brazil.

The lack of transparency regarding whether this fee is tied to a contract and its duration raises concerns about potentially ongoing costs.

And, of course, this cost is going to cut into your bottom line.

The other issue is related to customer satisfaction.

Handling international payments, especially from Brazil, involves navigating complex tax laws, legal compliance, and fees.

Therefore, support or the lack of it, can be a big problem.

Ebanx’s customer support has been criticized for its inadequacy, with a notable lack of responsiveness on Brazil’s major review platform, Reclame Aqui, where over 50% of customer complaints remain unanswered.

Reclame Aqui considers Ebanx a “Not Recommended” Business, based on this lack of customer support.

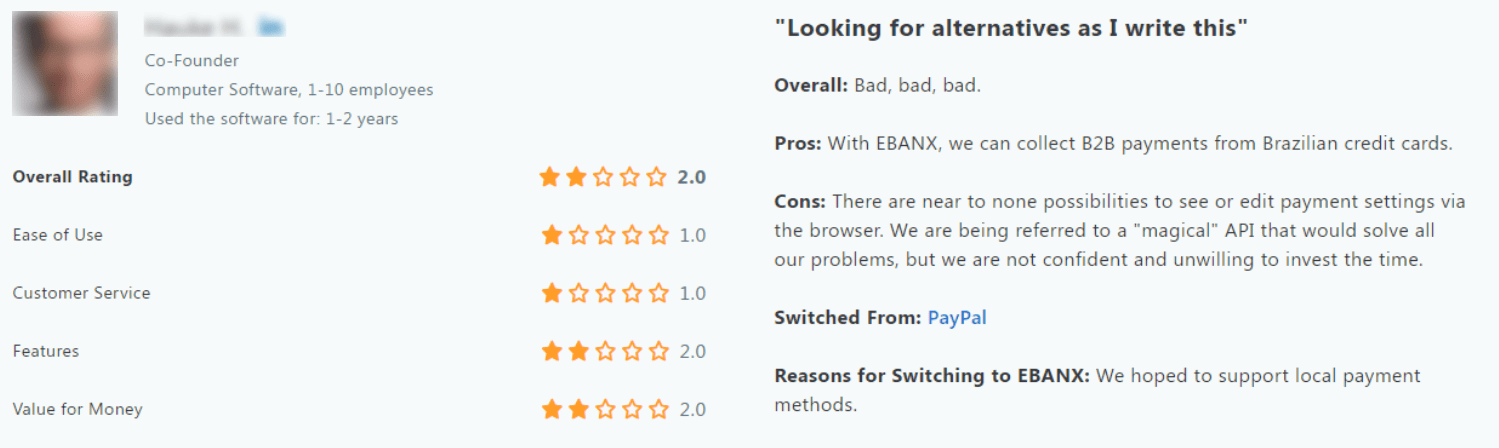

Then there is the client side of the issue. Again, with a little bit of research on software review websites, we can see that a lot of business owners are unhappy with their service.

Their main complaints seem to be related to pricing, but also lack of tech support when implementing the API, which can be tricky.

Right, so what is the alternative for a company wanting to process payments from Brazil with better support and more cost effectiveness?

Introducing CambioCheckout

CambioCheckout emerges as an ideal solution for medium to small-sized businesses in sectors like law, IT, education, SASS or retail, seeking an easily scalable payment processing solution with robust support for international transactions, particularly in Brazil.

Key Advantages of CambioCheckout:

- Personalized Support: CambioCheckout distinguishes itself by offering personalized support via live chat in both Brazilian Portuguese and English, catering to the needs of both businesses and their clients.

- No Hidden Fees: Or no fees whatsoever for your company. Remarkably, CambioCheckout operates without subscriptions, fees, or hidden charges for companies.

Businesses receive the exact amount in USD billed to customers, thanks to a revenue model based solely on exchange rate spread. This means your customer pays about 2% spread on transactions and there are zero costs to businesses. - Comprehensive Free Services: The platform provides a free API, IT support, and onboarding process, ensuring no additional costs for businesses exploring this solution.

- Settlements without minimum requirements: While huge processors such as Ebanx require a minimum amount for balance withdrawal, CambioCheckout does not.

You will automatically receive payments directly to your US. bank account regardless of your volume.This aligns with the platform’s intent to serve small and medium sized businesses with efficiency. - Flexible Payment Options: CambioCheckout supports diverse payment methods like Pix, Boleto, and national credit cards, offering convenience through payment links shared via email or WhatsApp.Funds are transferred to an American bank account within three business days.

- Unmatched Customer Support: Unlike Ebanx, CambioCheckout boasts a 100% response rate on Reclame Aqui, and a Live human chat right on the payment page, ensuring all customer payment issues and questions are promptly addressed.

CambioCheckout stands out as a tailor-made solution for small to medium sized businesses that wish to expand operations to the Brazilian market, offering significant advantages in terms of cost-effectiveness and customer support.

We encourage you to consider CambioCheckout as a viable alternative for your business.