Outsourcing to Brazil

All laws and regulations related

Brazil is one of the best destinations for labor outsourcing, especially in IT and technology in general.

Today, we’ll present a simple guide into related laws and regulations that can make a difference for businesses who are considering outsourcing to Brazil. Check it out!

Government Support and Regulations in Brazil

The Brazilian Government has invested efforts into making Brazil a great target for outsourcing.

Those efforts consist mostly of incentives for international companies to hire in Brazil and also, compliance of Brazilian work laws to international standards.

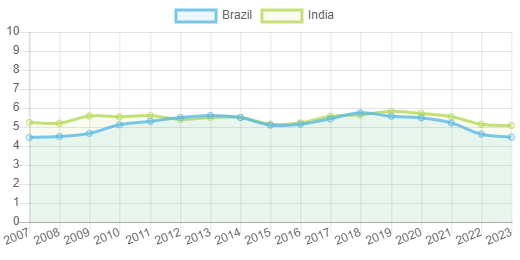

Brazil has a democratic government with a mostly stable political atmosphere, therefore, it has been considered as stable as other developing countries like India, by the International property rights index with data based on the world bank.

Also, Brazil has recently created new laws related to privacy compliance (LGPD) so that they would be on par with European Privacy Standards (GDPR), making for easier commercial relations between the regions.

Beyond that, the Brazilian Government is not big into regulating foreign businesses interests into the country.

Actually, most new laws approved in Brazil, like “Lei da Informatica”, were made to promote IT jobs by giving tax breaks for the companies hiring.

Most international companies that hire in Brazil have only to be compliant to Brazil’s laws and regulations as any native business would.

Now that remote work is common, it’s even fairly easy to hire in Brazil without having to maintain a local branch in the country.

In such cases, by law, the hiring must be made as a contractor category called “MEI” (Micro Empreendedor Individual) or as a business to business contract “ME” (Micro Empresa).

You can learn more about such cases here.

Taxwise, it is beneficial for the company to not have a branch in Brazil.

That would allow the company to have no fiscal relations with the Brazilian Government, leaving all fiscal and financial contributions limited to the USA or whatever country the headquarters is located.

It has to be said though, that there are laws limiting contractors to avoid relations of Employer-employee between a contractor and the hiring company.

You should seek legal counseling before deciding if MEI contractors are the best option for you!

Outsourcing to Brazil in the IT and technology sectors offers significant opportunities for global businesses.

By understanding and adhering to Brazilian laws and regulations, companies can benefit from the country’s growing outsourcing market.